Actually trading is also another very good profession like other works. If you do a Job in this field you even need to be CFA Certified Financial Analysts for your credibility after your CA, MBA(Finance) or after BCom

If your trade history is good enough you can even land in a job called Fund Manager or their Head for Capital Firms. Capital firm’s work is to make investments and profit out of it. These firms invest in listed and non listed firms both, in listed through their company’s Dmat Accounts or with a direct account in National Stock Exchange.

Hopefully all goes well, and I shall be starting Gupta Money Growth and Capital Fund GuptaMoney.com after more practice. But I am in no hurry, because I am already tied with existing startup plans.

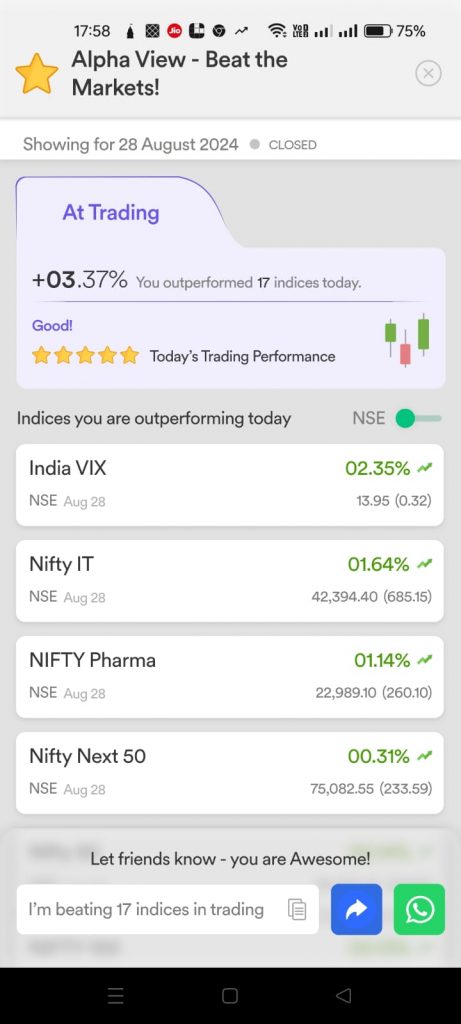

Many say 3% to 5% is too little in Intraday. But when capital becomes huge this percentage makes a big amount.

It is the equivalent of the interest one receives in a bank over a period of 6 months.

Going for more than 5% involves higher risks that can even bring losses moreover that becomes speculation till you are not practiced to recover losses on the same day or at most next day.

Another good strategy is to divide your capital in 4 parts:

- Intraday trades: Daily Income

- Positional trades: Weekly Income

- Short Term trades : Monthly Income

- Long Term trades : Quarterly Income

Grocery shop of an uncle trades the FMCG items but it took at least a generation to make customers & when D-Mart, Reliance Smart Bazar etc. like stores comes into picture then customers cut down into 50% to 30%

But here with practice you can get better and better, just preserve your initial capital that you start with.

All with Blessings of Guru Ji

Jai Guru Ji Shukrana Guru Ji 🙏🌹✨

I hope you enjoy reading

Mudit Gupta